franklin county ohio sales tax rate 2019

The 725 sales tax rate in Franklin Furnace consists of 575 Ohio state sales tax and 15 Scioto County sales tax. This is the total of state and county sales tax rates.

Ohio Remote Worker Tax Cases Pending

- The Finder This online tool can help determine the sales tax rate in effect for any address in.

. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. The December 2020 total local sales tax rate was also 6750. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business.

There is no applicable city tax or. The county and the transit. If you need access to a database of all Ohio local sales tax.

The latest sales tax rate for Franklin OH. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. Franklin County Ohio Sales Tax Rate 2019.

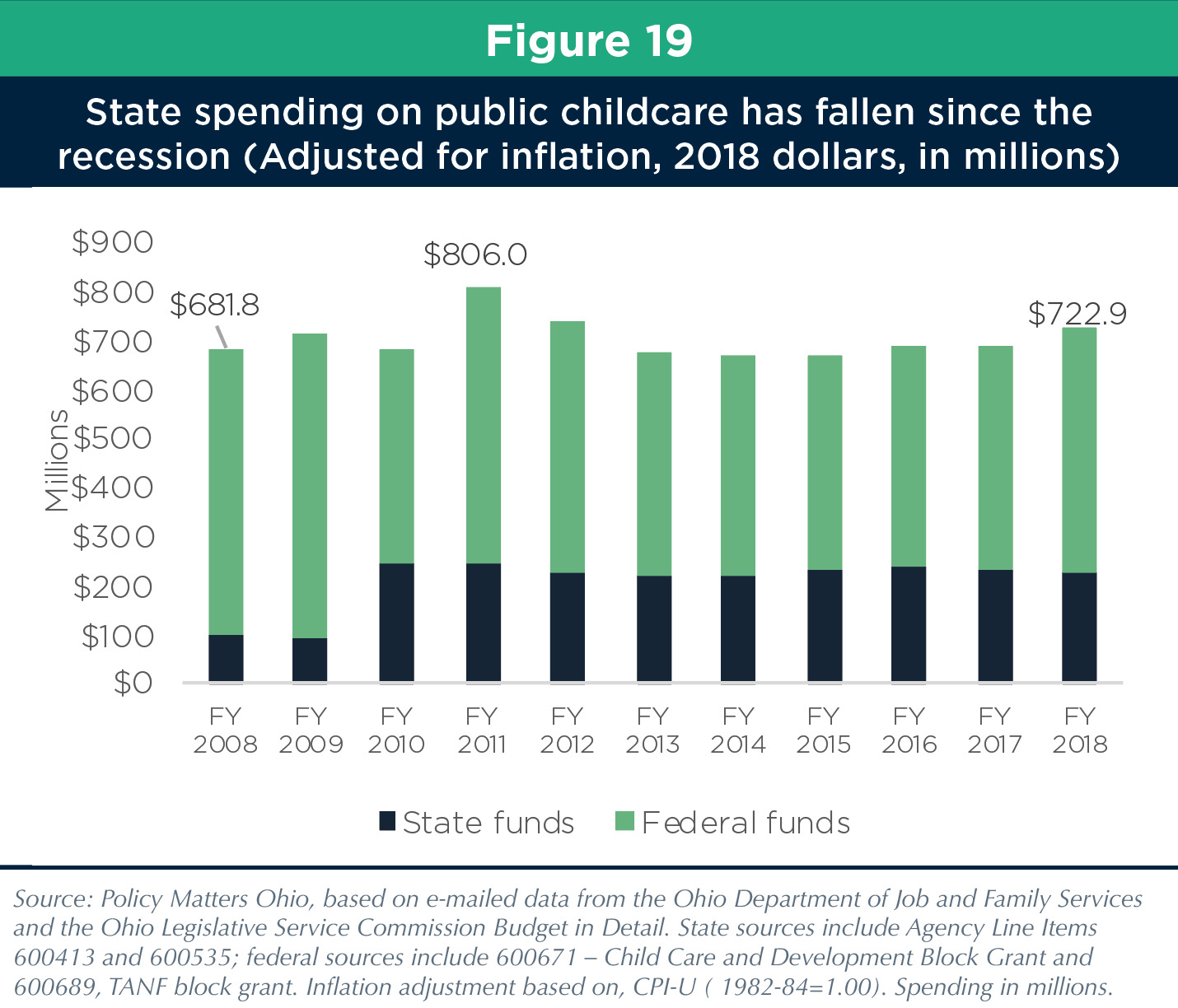

As of December 31 2019 the Ohio Department of Taxation administered permissive sales and use taxes for each Ohio county and nine transit authorities. Ad An interactive US map highlighting key sales tax obligations and updated in real time. 2020 rates included for use while preparing your income tax deduction.

The Ohio sales tax rate is currently. 075 lower than the maximum sales tax in OH. Unclaimed Funds FAQ.

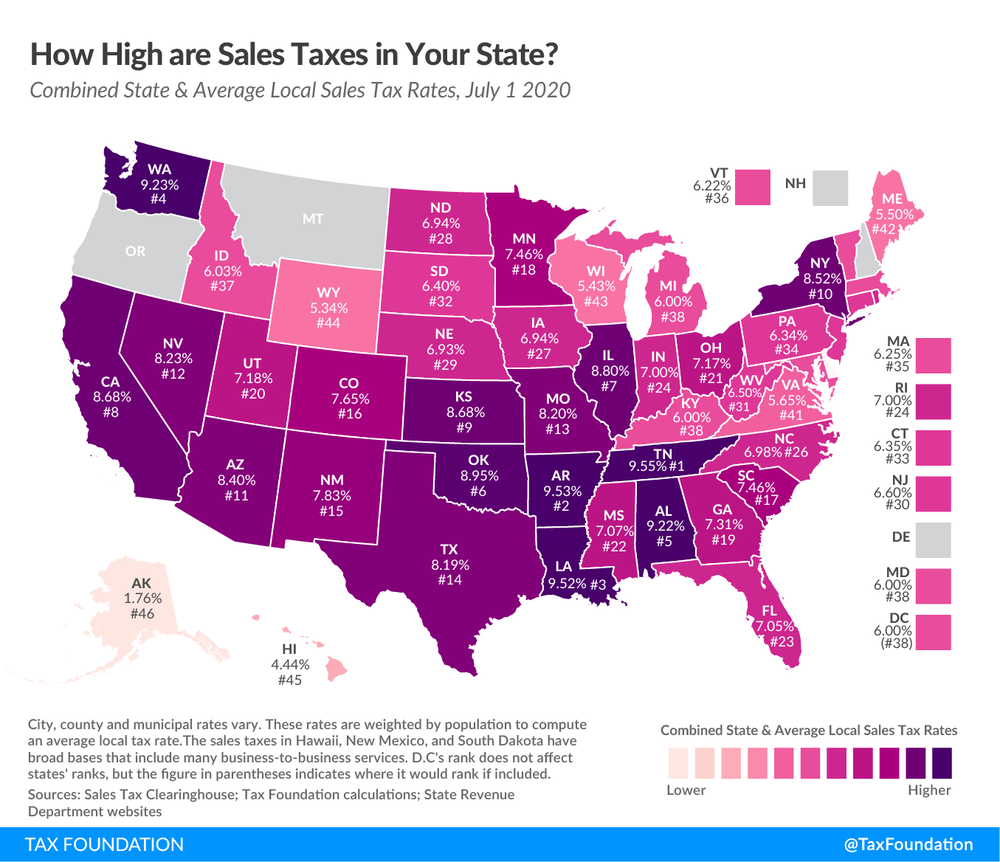

Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes. Rates include state county and city taxes. The latest sales tax rates for cities in Ohio OH state.

What is the sales tax rate in Franklin County. The divisions duties include the collection of delinquent taxes and working with property owners. The sales tax jurisdiction.

Franklin county ohio sales tax rate 2019 Wednesday March 30 2022 Edit. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

Sellers use our guide to keep current on all nexus laws and the collection of sales tax. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. Delinquent tax refers to a tax that is unpaid after the payment due date.

2020 rates included for use while preparing your income tax deduction. ESTATE TAX FILING. This rate includes any state county city and local sales taxes.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. The latest sales tax rate for Franklin County OH. The County sales tax rate is.

There is no applicable city tax. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Unclaimed Funds Search.

The current total local sales tax rate in Greene County OH is 6750. Ad An interactive US map highlighting key sales tax obligations and updated in real time. This is the total of state county and city sales tax rates.

Voters in Guilford County are being asked to support a 17 billion bond and a quarter. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Franklin Ohio is.

For the 1st quarter of 2020 Franklin County collected 821 million in sales tax which is 14 million or 17. This can range from 50 to over 300 depending on the. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

BUDGET. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. 1 lower than the maximum sales tax in OH.

To automatically receive bulletins on sales tax rate changes as they become. North Carolina Thu 30 Jun 2022 FACILITATOR-CURRICULUM 4156 per month Guilford County Schools.

Sam Randazzo Secretly Bought 5 Ohio Properties

Ohio Sales Tax Rates By City County 2022

Which States Have The Lowest Tax Rates Seniorliving Org

Income Tax City Of Gahanna Ohio

Sales Taxes In The United States Wikipedia

Financial Disparity Between School Districts Franklin County Oh School Society Research Pages For Educators Administrators

Indiana Tax Rate Chart Internal Revenue Code Simplified

Sales Taxes In The United States Wikipedia

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Local Income Taxes City And County Level Income And Wage Taxes Continue To Wane Tax Foundation

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Ohio Sales Tax Rate Rates Calculator Avalara

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions